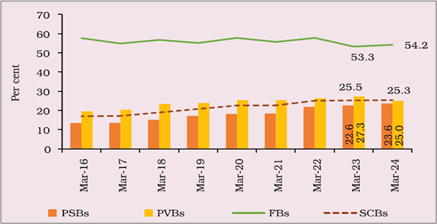

Unsecured loans are credit facilities that do not require collateral, including credit cards, personal loans student loans, payday loans, and line of credit. Due to the absence of asset backing, they carry a higher risk, making it difficult to recover in case of default. As a result, these loans typically have higher interest rates, lower borrowing limits, and shorter repayment terms. However, they offer flexible usage, minimal documentation, and faster approval, making them a convenient option for borrowers with a strong credit score. As a result, the share of unsecured loans in total credit disbursed by SCBs (Scheduled Commercial Banks) rose to 25.3 per cent in March 2024 from around 18 per cent in March 2016 (Figure 1):

Figure 1: Bank-group Wise Share of Unsecured Advances Excluding Regional Rural Banks

Source: Report on Trend and Progress of Banking in India 2023-24, RBI

Unsecured lending is also significantly influenced by income levels. Individuals with lower incomes, who often lack tangible assets for collateral, perceive unsecured loans as a more accessible and convenient option due to minimal documentation requirements. RBI’s December 2024 Financial Stability Report, indicates that as of September 2024, individuals with an annual income of less than INR 5 lakh had the highest share of unsecured loans within total personal loans, while those earning INR 15 lakh and above had the lowest share.

Unsecured loans have witnessed unprecedented growth, with unsecured personal loans comprising nearly one-third of the total personal loan credit of INR 41 lakh crore as of March 31, 2023. This surge is driven by macroeconomic factors such as demographic shifts, a growing income-earning population, rising purchasing power, increased risk appetite, and enhanced financial literacy. Technological advancements, including digital stack, widespread internet access, and online KYC, have further fueled financial innovation. The convergence of technology and finance, led by FinTech companies, has revolutionized lending by enabling easy access to credit through digital lending. By offering innovative financial products with simplified processes and customization, FinTech firms have outpaced banks, commanding a majority share of personal loan disbursements in H1FY25.

Unsecured loans pose higher credit risks for banks in case of defaults. While banks have significantly reduced NPAs from 11.2 per cent in March 2018 to a 12-year low of 2.6 per cent in September 2024, concerns are emerging over the quality of retail loans, particularly unsecured lending, which accounted for 51.9 per cent of new NPAs in the retail portfolio in H1FY25. Unsecured lending by NBFCs has also surged, growing at 28.1 per cent—more than twice the 11.5 per cent growth of secured loans by March 2023. These trends pose systemic risks, as various institutions, including banks, NBFCs, MFIs, and FinTechs, continue expanding unsecured lending. Nearly 50 per cent of unsecured loan borrowers already have another live retail loan, often high-ticket ones like housing or vehicle loans. A default in one loan category can escalate delinquencies across other loans, as lending institutions classify all loans held by the same borrower as non-performing, heightening risks for larger, secured portfolios. Thus, unsecured lending not only presents significant credit risks for financial institutions but also has the potential to evolve into a broader systemic risk if not effectively monitored by regulators.

The RBI took cognizance of the situation in November 2023 by announcing some regulatory measures to mitigate the risks arriving out of increased unsecured lending by:

- Increasing risk weights on consumer credit for banks and NBFCs from 100 per cent to 125 per cent, excluding housing, education, vehicle, and gold-backed loans. Similarly risk weights on credit card receivables were increased from 125 per cent to 150 per cent for SCBs and 100 per cent to 125 per cent for NBFCs. It allowed for higher capital allocation, strengthening loss buffers, and curbing excessive loan growth. As a result, the banking system’s Capital to Risk-weighted Assets Ratio (CRAR) is estimated to decline by 71 bps to 16 per cent.

- The RBI further directed Regulated Entities (REs) to enhance credit standards by setting caps on unsecured consumer credit exposure. The risk management committee must continuously monitor these limits, ensuring strict adherence.

- Former RBI Governor, Shaktikanta Das also stressed the importance of banks monitoring the end-use of unsecured loans due to their open-ended nature.

Note that on 25th February 2025, RBI had lowered the risk weights of bank’s exposure to NBFCs due to liquidity crunch to spur economic growth. However, the analysis focuses on the regulatory measures put forward by RBI on November 2023 to curb increase in unsecured loans. The regulatory measures showed some improvement in unsecured lending portfolio of SCBs, whose share declined marginally to 25.3 per cent (March 2024) from 25.5 per cent (March 2023). However, H1FY25 shows even greater improvement as unsecured personal loans and credit card borrowing growth slowed down to 11 per cent and 18 per cent (Y-o-Y), from 22 per cent and 25 per cent CAGR between FY21 and FY24, respectively.

RBI conducted a study to assess the impact of recent regulatory changes on NBFCs' unsecured retail lending. The findings indicated that the countercyclical prudential measures effectively curbed the growth of unsecured lending, aligning with the policy objectives. Unsecured lending growth by NBFCs has declined drastically following RBI’s announcements (Figure 2)

Figure 2: Trends in Retail Credit by NBFCs

Source: Report on Trend and Progress of Banking in India 2023-24, RBI

The rise of digital lending and growing financial literacy in India has expanded credit access, especially among underserved sections. Unsecured lending, with its minimal documentation and collateral-free loans, has been boosted by technological advancements in the financial sector. However, this rapid growth has introduced rising credit risks within the banking sector, potentially leading to systemic risks if left unchecked. RBI’s timely intervention has helped mitigate these risks while maintaining access to credit for low-income groups. As FinTech revolution makes inroads in India, it is crucial for lenders to adopt responsible credit practices and for borrowers to maintain financial discipline.

*Vanshika Goyal is Research Assistant at RIS. Views expressed are personal. Usual disclaimer applies.

Author can be reached out at vanshika.goyal@ris.org.in.

References:

- Financial Stability Report, Dec 2024; https://rbidocs.rbi.org.in/rdocs//PublicationReport/Pdfs/FSR30122024F992B788790C44DCFBA4E8C9F98D912D9.PDF

- Financial Stability Report, June 2024; https://rbidocs.rbi.org.in/rdocs//PublicationReport/Pdfs/0FSRJUN2024_270620242B95CB128D1847A3ACAB5B5A4BEBF0DF.PDF

- Financial Stability Report, Dec 2023 https://rbidocs.rbi.org.in/rdocs//PublicationReport/Pdfs/0FSRDECB815B9437D6D428F81D45C22BBF6C62A.PDF

- Economic Survey of India 2024-25; https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf

- Trend and Progress of Banking in India 2023-24; https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/0RTP261220247FFF1F49DFC04C508F300904A90C7439.PDF

- CareRatings: UNSECURED LENDING: OPPORTUNITY FOR GROWTH OR LOOMING RISK?; https://www.careratings.com/uploads/newsfiles/1702365751_CareEdge_FORESIGHTS_Dec_2023.pdf

- Policy document issued by RBI, “Regulatory measures towards consumer credit and bank credit to NBFCs”; https://www.pdicai.org/Docs/RBI-2023-24-85_2011202311549368.PDF