Income and wealth inequality is a prominent topic among policymakers and economists worldwide. Historically, various schools of thought have emerged regarding its causes. Adam Smith (1884) argued that a society cannot flourish if the majority of its members are poor and miserable, focusing on the distribution of wages, rent, and profits. David Ricardo emphasized income distribution in political economy, asserting that it should determine the laws governing income distribution and highlighting the division of rent and profits. He was recognized as the first economist to develop a meaningful theory of income distribution (Bigsten, 1983).

Over time, attention shifted to the conflict between wages and profits, particularly influenced by Marx's perspective. Marx drew from Ricardo's "labour theory of value," positing that labour surplus value is exploited through a "reserve army of labour." In contrast, neo-classical economists argue that all production factors are scarce and contribute to value creation. They suggest that product value reflects labour compensation based on individual output contributions. In the mid-20th century, the belief emerged that wealth accumulation by the rich would eventually trickle down to create an egalitarian society. However, Joseph E. Stiglitz noted that this theory did not align with postwar evidence in the US.

For a country to advance, it is essential to examine inequality alongside economic growth. Simon Kuznets hypothesized an inverted U-shaped relationship between economic development and inequality, suggesting that inequality increases with development until a tipping point is reached, after which it declines. However, evidence for this inverted U-curve is limited. Critics argue that Kuznets' data were collected during tumultuous periods like the Great Depression and World Wars when high taxes significantly impacted capital owners' wealth and income. Once these factors subsided, inequality rose again, contradicting Kuznets' theory. Thomas Piketty updated this model, proposing an S-shaped curve for the US, indicating low inequality initially, rising in the 19th century, declining in the 1920s, remaining low until the 1980s, and then increasing again. Piketty introduced capital as a central variable which is absent from Kuznets' analysis, asserting that capital is distributed less evenly than labour income.

In his book "Capital in the Twenty-First Century," Piketty explored the relationship between economic growth (g) and return on capital (r), claiming that if r>g, income inequality rises as wealth concentrates among capital owners rather than labours. However, in "About Capital in the Twenty-First Century," he acknowledged that while the gap between g and r influences income inequality's magnitude and variations, other factors like institutional changes and political shocks also play significant roles.

Recent empirical evidence challenges Piketty's assertion for India in the financial year 2023-24. The projected growth rate is approximately 8.1 per cent, surpassing current capital return rates: the Weighted Average Lending Rate (WALR) at 4.04 per cent and the Social Time Preference Rate at 4.5 per cent. This suggests wealth accumulation is lower than economic growth.

The relationship between growth (g) and return on capital (r) hinges on whether wages are saved or consumed. If all wages are consumed while profits are saved, the Incremental Capital Output Ratio (ICOR) can be expressed as:

g = (I/Y)/ICOR

where:

- Irepresent Invested Capital,

- Y denotes Output.

This can be simplified to show that:

g = (r.K/Y)/(K/Y)

which simplifies further to:

g = r

Thus, for growth (g) to exceed return on capital (r), two conditions must be met:

1. The ratio of capital to output (K/Y) must exceed ICOR.

2. A portion of wages must be saved rather than consumed.

These conditions imply that policies promoting savings and investment could enhance economic growth while positively impacting income distribution. By encouraging savings among workers and ensuring a greater share of profits is reinvested, a more favourable environment for sustainable economic growth can be established.

Recent analyses indicate a significant decline in income inequality in India when examining micro-level data rather than broad cross-country comparisons. The Gini Coefficient for consumption has improved from 0.283 to 0.266 in rural areas and from 0.363 to 0.314 in urban areas between 2011-12 and 2022-23, indicating a narrowing income gap.

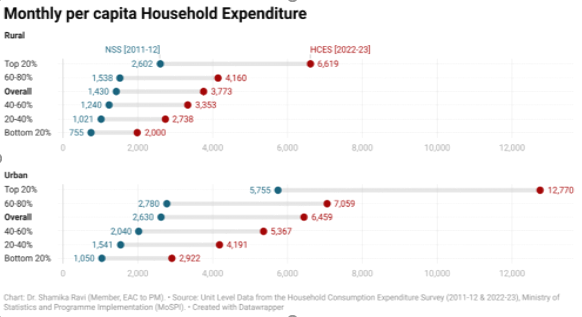

Additionally, findings from the latest Household Consumption Expenditure Survey (HCES) reveal reduced disparity in monthly per capita consumption expenditure between the top and bottom 20 per cent of earners: in rural areas from the ratio of 3.5 in 2011-12 to 3.3 in 2022-23.Similarly, urban areas saw a drop from approximately 5.5 to 4.4 during this period. These trends suggest growing economic mobility among lower-income groups.

Source: Dr. Shamika Ravi (2024)- Conference presentation:Inequality, Economic Growth and Inclusion. New Delhi.

Furthermore, there has been a remarkable 75 per cent increase in income among the poorest household’s post-pandemic, with 248 million people escaping multidimensional poverty between 2014 and 2023—an achievement considered more significant than merely counting billionaires. Asset ownership has also improved significantly among poor segments; vehicle ownership surged from just 4 per cent in 2011-12 to an impressive 40 per cent by 2022-23.

These findings collectively underscore reduced inequality and increased economic mobility in India over the past decade, suggesting targeted policies effectively address disparities in income and consumption across rural and urban landscapes.

In conclusion, the relationship between economic growth and societal well-being is intricate and multifaceted. The recent data from India demonstrates a positive trend in economic mobility, as evidenced by improvements in consumption patterns and asset ownership among lower-income groups. These developments suggest that the country is making strides toward a more inclusive economic environment.

Ultimately, sustainable economic growth should not only focus on increasing output but also on creating opportunities for all citizens to thrive. By prioritizing equitable access to resources and promoting inclusive policies, India can pave the way for a future where economic progress translates into improved living standards and enhanced quality of life for its entire population. This holistic approach will be crucial as the nation continues to evolve in an increasingly complex global landscape.

For more information on the panel discussion, visit: https://www.ris.org.in/node/3993

*Vaishali Chaudhary is Research Assistant at RIS. Views expressed are personal. Usual disclaimer applies.

Author can be reached out at vaishali.chaudhary@ris.org.in.

References

- Arne Bigsten, Income Distribution and Development: Theory, Evidence, and Policy (London: Heinemann, 1983), viii + 192

- Piketty, Thomas. 2015. "About Capital in the Twenty-First Century." American Economic Review, 105 (5): 48–53.

- Gallo, C. (2002). Economic growth and income inequality: theoretical background and empirical evidence. London: Development Planning Unit, University College London.

- National Sample Survey Office. Report of Survey on Household Consumption Expenditure: 2022-23. Ministry of Statistics and Programme Implementation, 2024.